Summary: Invoice factoring helps companies that need funds to pay expenses. It improves the company’s working capital by financing invoices from slow-paying customers. It has become a popular financing tool for small and mid-sized Canadian companies. This article provides a detailed explanation of the solution and covers:

- What is factoring?

- What is the advance rate?

- How much does it cost?

- How are invoices verified?

- Recourse vs. non-recourse

- Qualification requirements

- Advantages

- Due diligence

- Is factoring right for my company?

1. What is factoring?

Companies that sell products or services to other businesses usually must agree to get paid on net-30 to net-60 terms by their customers. Payment terms are common in commercial transactions but often create working capital problems for small companies.

Companies can improve their working capital by using invoice factoring. Factoring works by financing your invoices from creditworthy but slow-paying clients. It provides your company with immediate funds that can be used to pay for business expenses and to take on new clients.

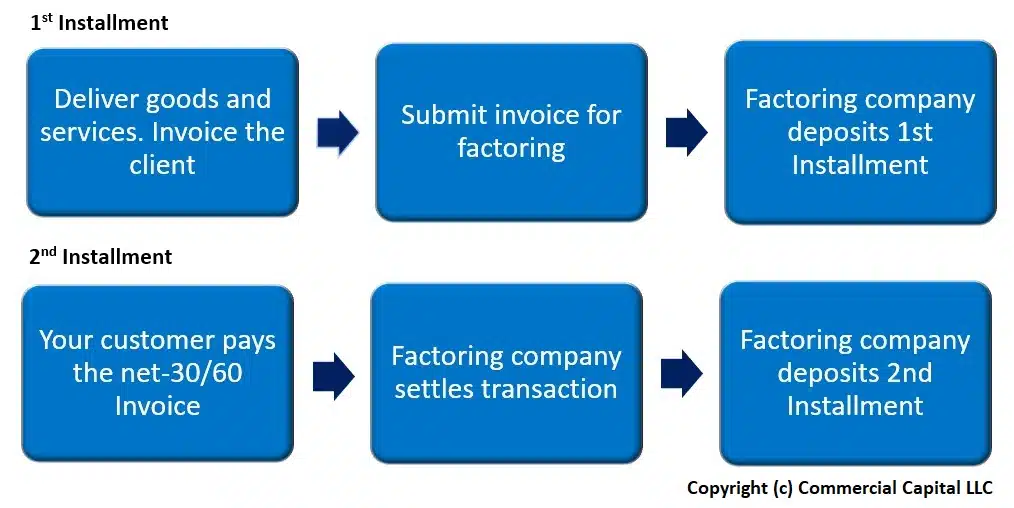

Factoring companies usually finance accounts receivable by purchasing the invoices in two instalments. The only exception is the transportation industry, where factoring companies can do single-instalment transactions.

The first instalment is called the advance. It covers 80% to 95% of the total invoice value. The advance is deposited into your bank account shortly after you submit your invoices to the factoring company. The remaining funds, less the factoring company’s fee, are deposited into your bank account as a second instalment once the end customer pays. This second instalment settles the transaction. To learn more, read “How Does Factoring Work?”

2. What is the advance rate?

The advance is the first instalment the factoring company deposits into your bank account. It is based on a percentage of the invoice’s total value. Advances vary based on industry and transaction risk, though they average 85% of the value of the invoice. Here is a list of average advance rates for several industries:

- Staffing: 90% to 95%

- Transportation: 90% to 97%

- Oil and gas: 80% to 95%

- Manufacturing: 80% to 90%

- Consulting: 80% to 95%

- Distribution: 80% to 85%

- Construction: 75% to 85%

3. How much does factoring cost?

The factoring fee varies based on the financed volume, industry, and general transaction risk. The average rate ranges from 1.5% to 4.5% per 30 days of usage. The fees can usually be pro-rated based on how long your customers take to pay an invoice. Three pricing structures are common in the factoring industry.

a) Flat fee

The flat fee is a simple pricing model popular with small transportation carriers. The price is a fixed percentage of the invoice regardless of how long it takes your customer to pay (with some exceptions). For example, the factoring company could charge a flat 2.5% for the transaction.

b) Block of days (“tiered rates”)

This pricing model is the most common in the industry. The factoring company charges a percentage for a block of days. For example, the factoring company could charge 1% per 10 days. In this example, an invoice would cost 1% if paid in 9 days, 2% if paid in 19 days, and so on.

c) Discount plus utilisation

This pricing model is common for larger transactions. The finance company charges a small flat discount on the total invoice value and a time-based incremental percentage on the used funds. It is similar to the pricing model used for receivables-backed lines of credit.

4. Invoice verifications

Factoring companies usually verify invoices before depositing the advance into your account. The verification process ensures that the invoice’s information is accurate. Invoices are verified through one of the following methods:

- Vendor portal (preferred)

- Phone calls

Most factoring companies use a soft-approach verification method, though each factor uses a proprietary method. Note that verifications are not intended to be collections calls.

5. Recourse vs. non-recourse

Recourse determines the actions a factoring company can take if an end customer does not pay an invoice. Factoring transactions can be structured as “full recourse” or “non-recourse” transactions. Every factoring company offers a specific version of recourse which is defined in their contract.

a) Recourse factoring

A factoring transaction with full recourse allows the factor to return an unpaid invoice after a specified number of days, usually 90. This model is the most common type of factoring structure.

b) Non-recourse

In a non-recourse transaction, a factoring company will not return the invoice to the client if the end customer does not pay due to declared insolvency (e.g., bankruptcy). Invoices not paid for other reasons can usually be returned to the client.

Note: Factoring companies have the right to return an invoice that is disputed by your end customer.

c) Which option is better?

In principle, non-recourse provides some protection if your end-customer declares bankruptcy and becomes insolvent. However, most factoring companies have sophisticated credit review systems that should prevent them from financing high-risk invoices in the first place.

6. Qualification

Factoring is commonly used by small and growing companies that cannot get bank financing. Qualifying for a factoring plan is easier than qualifying for a conventional bank line of similar size. The most important requirements are to have:

- Creditworthy commercial clients

- Invoices that pay in less than 90 days

- Invoices that are free of liens

- A well-managed business

7. Advantages

Using a factoring line to finance your accounts receivable has several advantages for your company. Here are a few of them.

a) Improved cash flow

The most important advantage of factoring is that it immediately improves your company’s working capital. It provides the funds to pay business expenses and take on new projects.

b) Extend payment terms with confidence

A factoring line enables you to extend net-30 terms to creditworthy customers while minimizing your concerns about cash flow. The financing line allows you to always factor your invoices when you need liquidity.

c) Quick funding

Factoring lines can usually be set up in about a week or so. You may be able to get funded in a shorter time if you have all the information that is requested in the application readily available.

8. Due diligence

Factoring companies have a short due diligence process that can be completed in a couple of days. The process varies by company, but factors usually ask for:

- Corporate documents

- A/R Aging Report

- Sample invoices

- Company information

The factor will also verify that there are no liens encumbering your invoices. In most provinces, this requires a PPSA search. The exception is Quebec, where the factor must search for a hypothèque.

9. Is factoring the right solution for you?

Invoice factoring can be a good solution for companies with financial challenges due to slow-paying clients. In general, factoring should help you if your:

- Clients have good commercial credit

- Clients pay in less than 60 days

- Profit margins are approximately 15% (higher is better)

However, every situation is unique. If you are uncertain about factoring, consult a qualified professional.

Get more information

Are you looking for a factoring quote? We are a leading factoring company and can provide you with high advances at low rates. For more information, get an online quote or call us toll-free at (877) 300 3258.