This article covers the ten most effective ways to finance a small or growing company. We cover several options that can be used to finance a wide range of situations. What do you need the funds for? There are several options you can use to finance a business. Some products are flexible and can be […]

How Does Factoring Work?

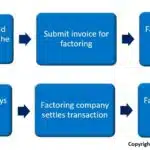

Factoring is a type of financing transaction that helps companies improve their cash flow. It finances slow-paying invoices, providing companies with working capital to operate the business more effectively. This article discusses how factoring works, how transactions are priced, and how Canadian factoring companies set up accounts. We cover: How does it work? The advance […]

What is Invoice Factoring?

Summary: Invoice factoring helps companies that need funds to pay expenses. It improves the company’s working capital by financing invoices from slow-paying customers. It has become a popular financing tool for small and mid-sized Canadian companies. This article provides a detailed explanation of the solution and covers: What is factoring? What is the advance rate? How […]

13 Free Load boards – Canada and Transborder

A load board is a marketplace that allows carriers, brokers, and shippers to work together. While the best way to grow a trucking carrier is to get direct shippers, load boards have a place to help you build your business. They are a useful way to get started and start pulling loads. Additionally, they can […]

Supplier Cost Financing for Manufacturing Companies

It’s impossible to grow a company if you cannot pay suppliers on time. Many manufacturing companies face this problem when they experience a growth phase. The reason is often simple. As your purchase orders from clients grow, so do your orders to your material/product suppliers. However, if growth exceeds the amount of credit that your […]

Do You Qualify for Supplier Financing?

Supplier financing is a form of trade credit financing available to manufacturing companies and distributors (learn more). Your company must meet the following requirements to qualify for this solution. 1. Be a manufacturer or product supplier Supplier financing is available only to manufacturing companies and distributors. The solution helps finance the costs of purchasing goods […]

What is Supplier Financing?

Supplier financing is a type of supply chain financing that is designed for manufacturers and distributors. It helps them cover supplier expenses, enabling them to fulfill large orders and build inventory. Supplier financing vs. supply chain financing The terms “supplier financing” and “supply chain financing” are often used interchangeably. Unfortunately, this is not entirely accurate. […]

How Does Inventory Financing Work?

Inventory financing is a type of asset based lending that allows your company to leverage existing inventory. It can provide your company with funds to purchase additional inventory or handle corporate expenses. From this article, you will learn: How inventory financing works What type of due diligence is required to set up a line Advantages and disadvantages of this […]

Inventory Financing vs. Purchase Order Financing

Both purchase order (PO) financing and inventory financing can be used to finance certain types inventory. However, both solutions work very differently and serve very different business objectives. From this article you will learn: What purchase order financing is What inventory financing is The main differences between these solutions How to determine which solution is right for […]

Can Asset Based Lending Finance a Small Business?

Asset based lending has been growing in popularity as a way to finance small and mid-sized companies. Asset based loans are easier to get than commercial lines of credit and provide more flexibility. Initially, asset based loans were offered only to mid-sized companies – those with at least 50 million dollars (CAD) in yearly turnover. However, some asset based […]