Becoming a distributor for a large big box retailer – companies such as Walmart, Loblaws, or Rona– can be both a important opportunity and a major challenge at the same time. Most big retailers can place large purchase contracts, which are great for revenues. However, they also negotiate payment terms that enable them to pay your invoices […]

PO Financing

Financing your Imports from China and Asia

Resellers and distributors often have to play a very delicate game of balancing their cash flow. This can even be more challenging if you are buying goods from factories in China, or anywhere in Asia for that matter. On one hand, the Chinese factories will want you to pay for the goods in a secure […]

Financing for Resellers and Distributors

For many resellers, distributors and importers, managing cash flow is a very important but delicate task. Unless you have a long established relationship with your supplier, they will likely ask you to prepay for goods – or pay upon shipment. On the other hand, your commercial clients will often demand to pay your invoices in […]

Purchase Order Financing Benefits

In recent years, purchase order financing has been gaining traction in the marketplace as a funding solution for distributors and resellers that need money to pay their suppliers. It solves a common problem – what to do when you have run out of working capital but still have purchase order to fulfil. This type of […]

Using PO Financing to Fulfill Large Orders

For a small business, getting a large order from a coveted client can provide an important opportunity to grow the company. If you manage the order correctly, your client is very likely to become a repeat customer. And a large order is almost always a stepping stone to even larger orders. However, if you get […]

Inventory Financing vs. Purchase Order Financing

Both purchase order (PO) financing and inventory financing can be used to finance certain types inventory. However, both solutions work very differently and serve very different business objectives. From this article you will learn: What purchase order financing is What inventory financing is The main differences between these solutions How to determine which solution is right for […]

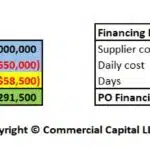

How Does Purchase Order Financing Work? (Sample Transaction)

Summary: Purchase order financing helps companies finance their supplier costs and enables them to handle large orders. It has grown in popularity with Canadian resellers and distributors. This article explains how purchase order financing works, how much it costs, and how transactions are settled. It also provides a detailed example of a transaction. We cover […]

Why Do Purchase Order Finance Transactions Require Inspections?

Most purchase order finance companies typically require that the goods they are financing be inspected by an independent company prior to shipment. Usually, the inspection company verifies that the quality, quantity, shipment date, and other parameters meet the specifications of the purchase order. The inspection clause is usually written into the language of the letter […]

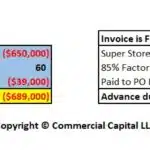

Settling PO Financing Transactions With Factoring

Summary: Purchase order financing transactions typically settle through an invoice factoring line. This settlement method adds complexity to the transaction but can provide additional working capital while lowering costs. However, these benefits do not apply to every transaction. This article discusses how the settlement process works and shows an example of a sample transaction. We […]

What is Purchase Order Financing?

Summary: Purchase order financing helps small companies that have won a large order and need funds to pay their suppliers. The solution helps cover the vendor expenses, enabling you to fulfill the order and book the revenue. PO funding has grown in popularity with Canadian resellers and distributors as a tool to grow their companies. […]