Summary: Purchase order financing transactions typically settle through an invoice factoring line. This settlement method adds complexity to the transaction but can provide additional working capital while lowering costs. However, these benefits do not apply to every transaction.

This article discusses how the settlement process works and shows an example of a sample transaction. We cover the following:

- Purchase order financing summary

- Invoice factoring summary

- Settlement process

- Sample transaction using factoring

- Is using factoring always better?

1. Purchase order financing summary

Purchase order funding helps distributors and resellers that need funds to fulfil an order. The finance company handles the supplier expense. This enables you to complete the order and send an invoice to your client.

Once you invoice your client, the transaction moves to the settlement stage. There are two ways to settle a transaction. The simplest way is to settle through the purchase order financing company. Alternatively, you can settle the transaction using an invoice factoring line.

Read “What is purchase order financing?” and “How does PO financing work?” to learn more.

2. Invoice factoring summary

Invoice factoring allows you to finance a commercial invoice that is due to be paid in 30 to 60 days. Invoices are typically financed in two instalments.

The first instalment is called the advance and covers around 85% of the invoice’s value. It is deposited into your account shortly after the invoice is factored.

The remaining 15%, less the factoring fee, is advanced once the end customer pays the invoice. This payment settles the transaction.

Read “What is factoring?” and “How does factoring work?” to learn more.

3. The settlement process

The simplest way to settle a transaction is directly through the PO financing company. Once your client pays their invoice, the purchase order financing company subtracts their costs and remits the difference to you.

However, you can also settle a transaction immediately after invoicing your client but before they pay you. It works by factoring the invoice at client delivery and using the advance to pay off the purchase order financing line. The transaction then continues as a factoring transaction.

Using a factoring line can lower your total costs or provide additional funds in some transactions. These transactions typically have high margins, short durations, and a good cost structure. The following section illustrates how to settle a transaction using a factoring line.

4. Sample settlement using factoring

The easiest way to understand how the settlement process works is to use a sample factoring transaction. Assume that ABC Supplies Inc. is a small distributor of electronic products to large retailers. They purchase their products from an overseas supplier called ACME Corp.

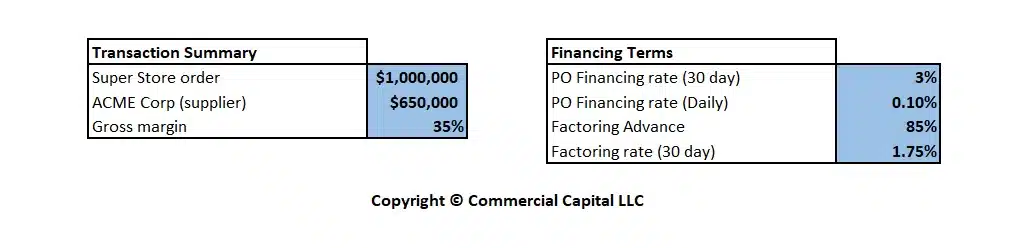

ABC Supplies gets a $1,000,000 CAD purchase order from Super Store Inc., a major retailer. ABC Supplies secures a quote from ACME Corp to buy the products for $650,000 CAD. This transaction has a 35% gross margin, a reasonable profit.

a) Financing plan

ABC Supplies negotiates with a purchase order financing company and a factoring company to finance the transaction. They agree on a PO financing rate of 3% per 30 days (prorated at 0.10 per day) and a factoring rate of 1.75% per 30 days. The factoring advance is set at 85% of the invoice.

The following table outlines the terms:

b) Transaction setup

The purchase order financing company opens a Letter of Credit (LOC) for $650,000 in favor of ACME Corp. The LOC guarantees ACME Corp payment upon fulfilment, so they begin manufacturing the order. After manufacturing, ACE Corp begins to fulfil the order.

c) Order fulfilment

The goods are inspected to ensure quality and then shipped to Super Store Inc. After reviewing the order, Super Store Inc. confirms that the goods arrived as ordered. ACME Corp collects the funds from the Letter of Credit. For simplicity, we assume the transaction took 60 days.

Since ABC Supplies has fulfilled the order, they issue an invoice for 1,000,000 to Super Store Inc. Super Store expects to pay the invoice in 30 days.

d) Factoring settlement with PO funder

ABC Supplies finances the invoice with the factoring company. The factoring line provides an 85% advance on the invoice, totaling $850,000. Part of the advance must be used to close the PO financing line.

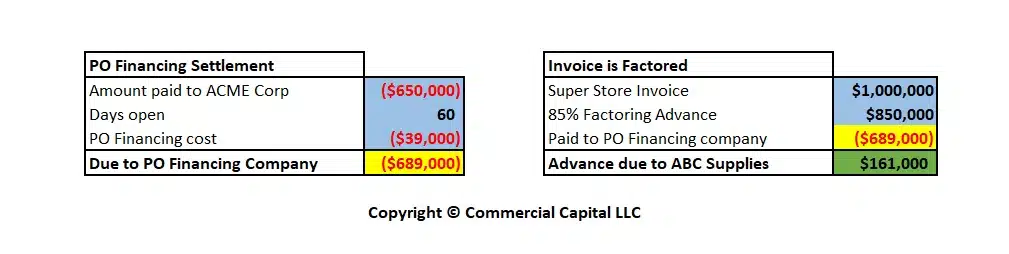

The funds needed to close and settle the purchase order financing line are as follows:

- $650,000 paid to ACME Corp

- $39,000 financing fee

The $39,000 financing fee is calculated by multiplying the $650,000 paid to ACME Corp by the daily cost of 0.10% for the 60 days the transaction was open. Adding both figures brings the settlement amount to $689,000.

The $689,000 cost to close the PO financing line is subtracted from the $850,000 advance. The remaining advance of $161,000 is advanced to ABC Supplies as working capital. ABC Supplies can deploy these funds as working capital for their business. The following table shows the transaction settlement details.

e) Super Store pays the invoice

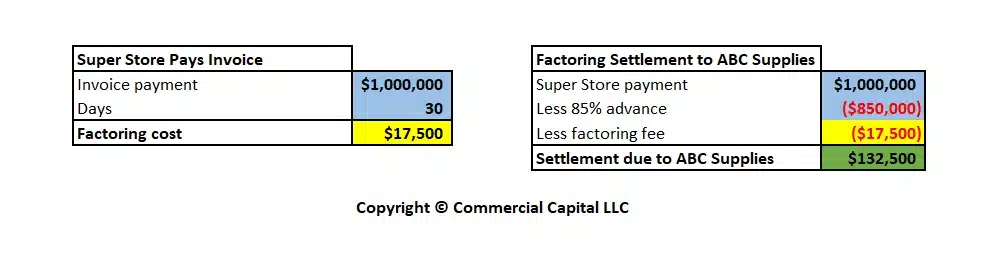

Super Store pays the $1,000,000 invoice after 30 days, and the factoring company settles the transaction. The factor subtracts the $850,000 they advanced initially along with their fee.

The factoring fee is $17,500. This is calculated by multiplying the $1,000,000 invoice by the 1.75% 30-day rate rate. This payment settles the factoring company’s position and provides ABC Supplies an additional $132,500 advance. The factor wires these funds to their account and concludes the transaction. The following table shows the settlement details:

4. Is using factoring cheaper or better?

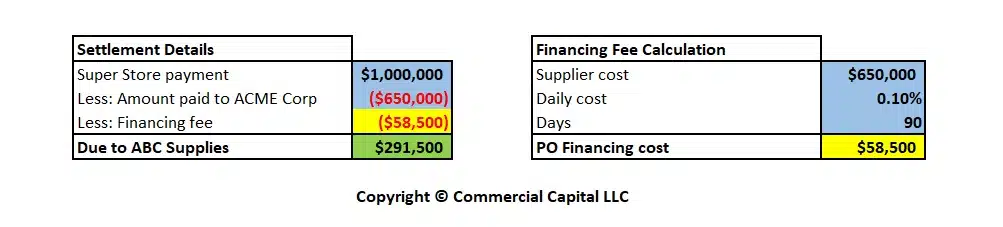

Let’s examine the transaction cost if ABC Supplies had only settled the transaction with the PO Financing company and without using factoring. In this scenario, ABC Supplies leaves the transaction open with the PO financing company until Super Store Inc. pays the invoice. This takes 90 days from beginning to end.

The cost for 90 days of PO financing is $58,500. We calculate this by multiplying $650,000 by the 0.10% daily cost by 90 days. The following table shows the transaction settlement.

a) Cost comparison

As the table below shows, using factoring in this transaction saved ABC Supplies $2,000. The benefit is marginal for a single transaction. However, it will add up if these transactions are done regularly.

b) Additional working capital

Using factoring accelerates some working capital that was tied to this invoice. This can be an important benefit if you have productive uses for those funds.

5. Should you always use factoring?

Using factoring in the settlement process only benefits some transactions. Furthermore, it increases the transaction’s complexity while the savings are not always substantial. In our opinion, the more important benefit comes from accelerating some working capital that can be deployed elsewhere in the business. Ultimately, the cost-benefit of using this settlement model must be evaluated carefully for each transaction.

Transactions that benefit from using a factoring settlement typically have a:

- High gross margin

- Short duration

- Favorable cost structure

Get a purchase order financing quote

We are a leading purchase order financing company in Canada and can provide you with competitive terms. For more information, get an online quote or call (877) 300 3258.